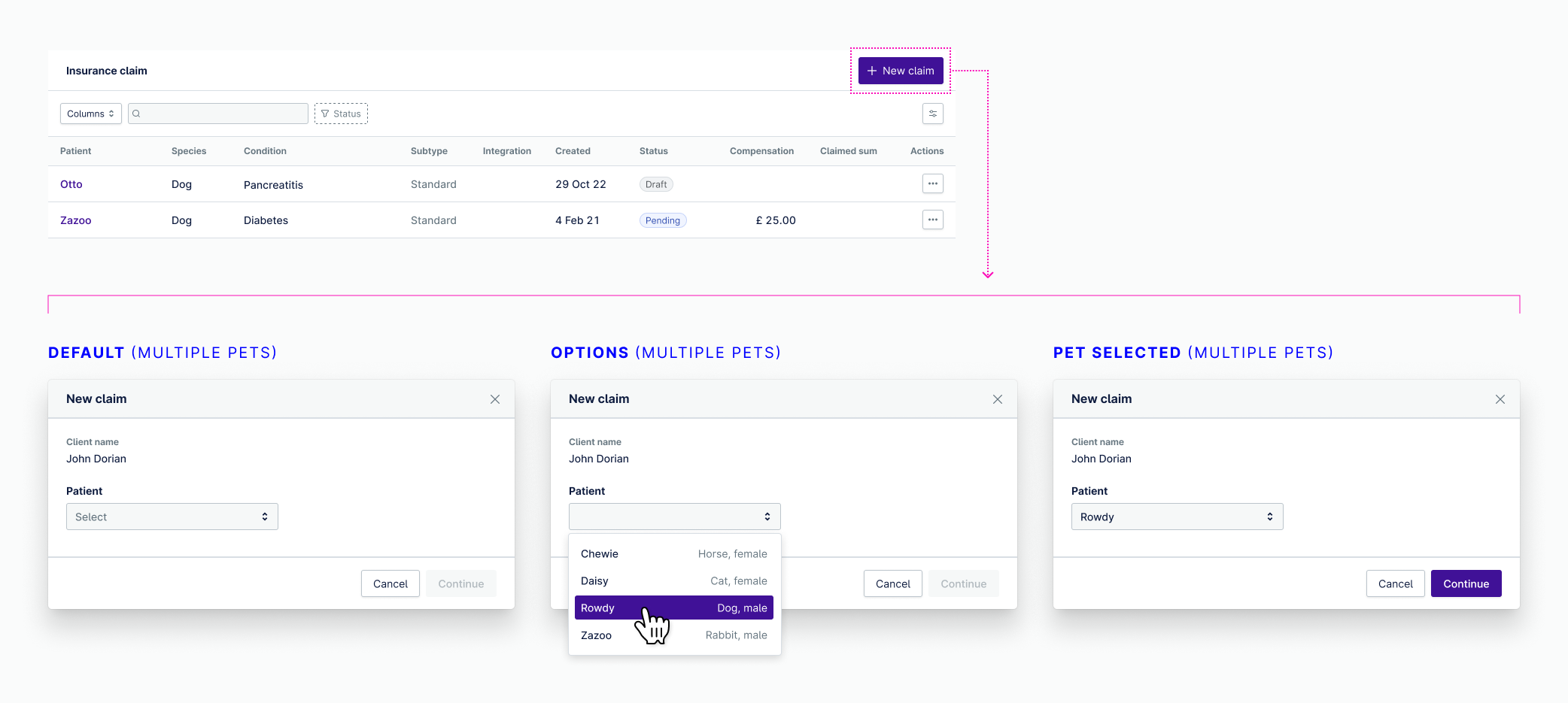

Creating a new insurance claim process for veterinary practices in the UK

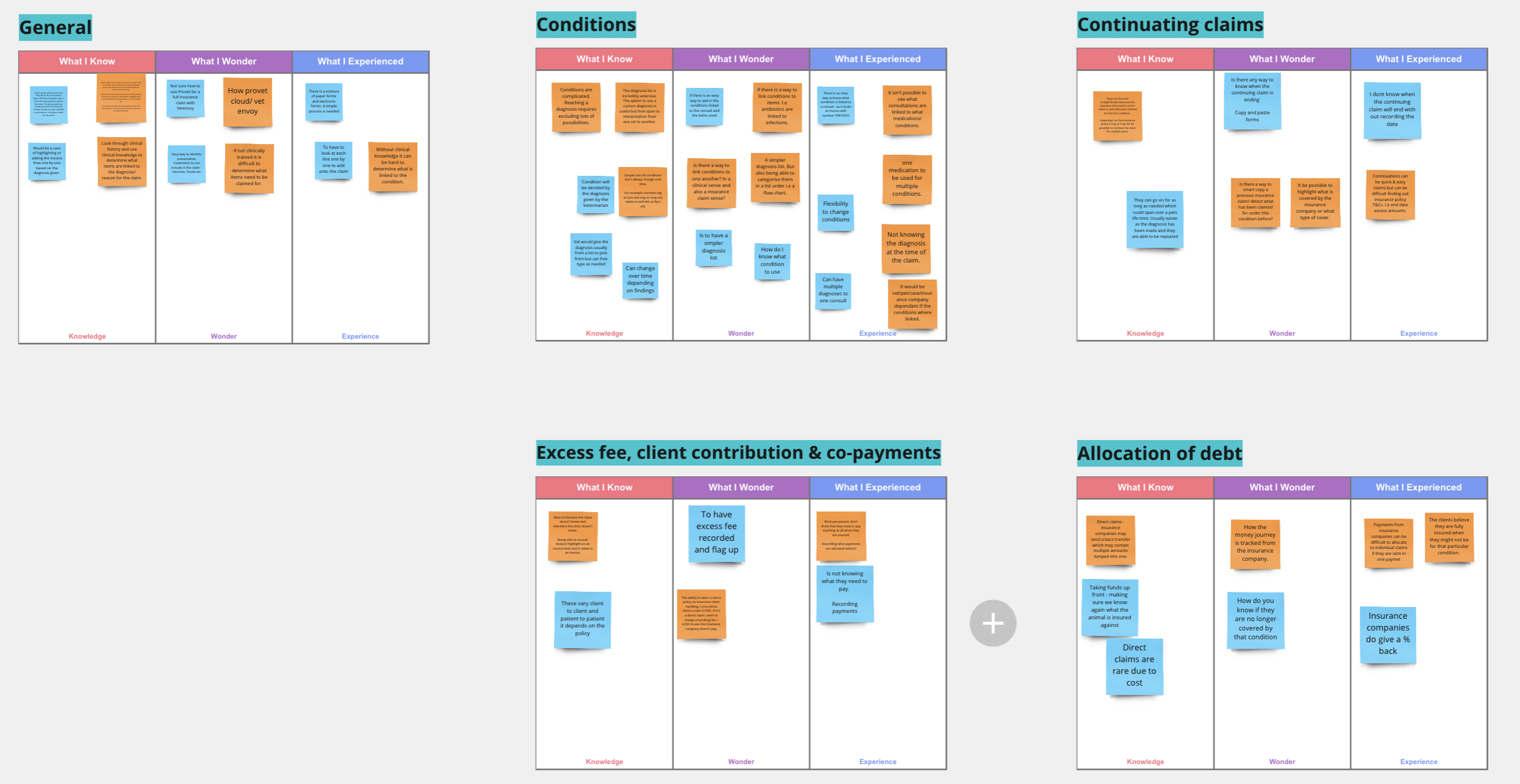

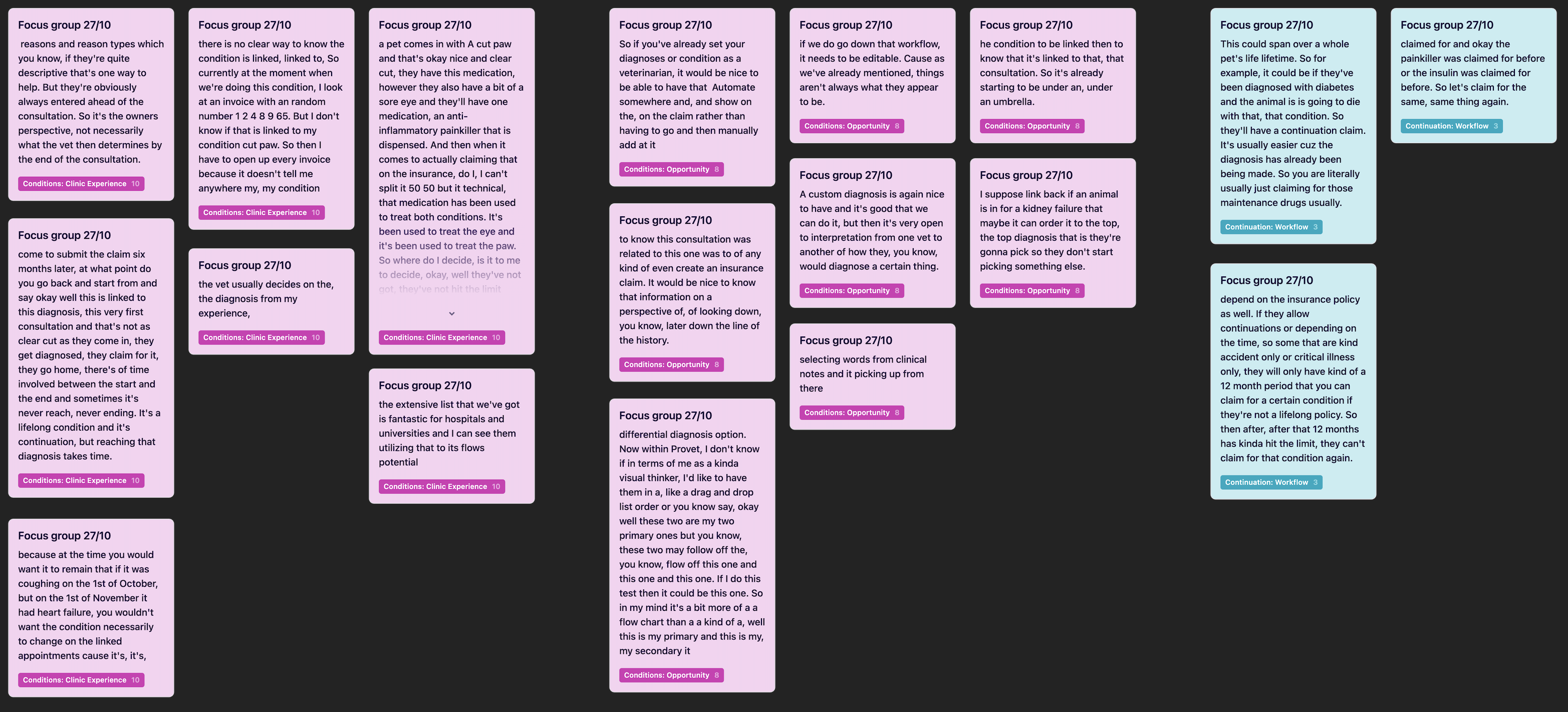

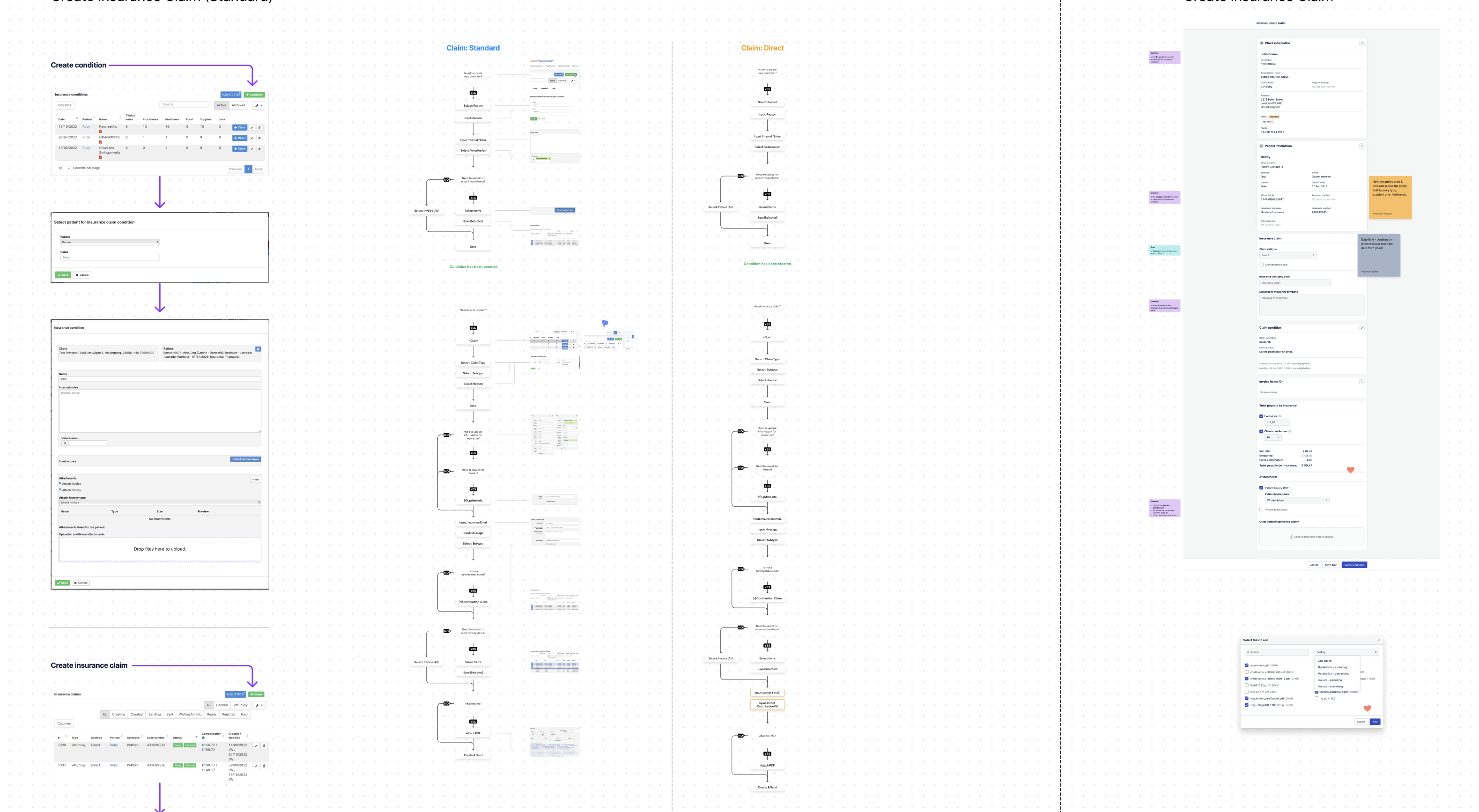

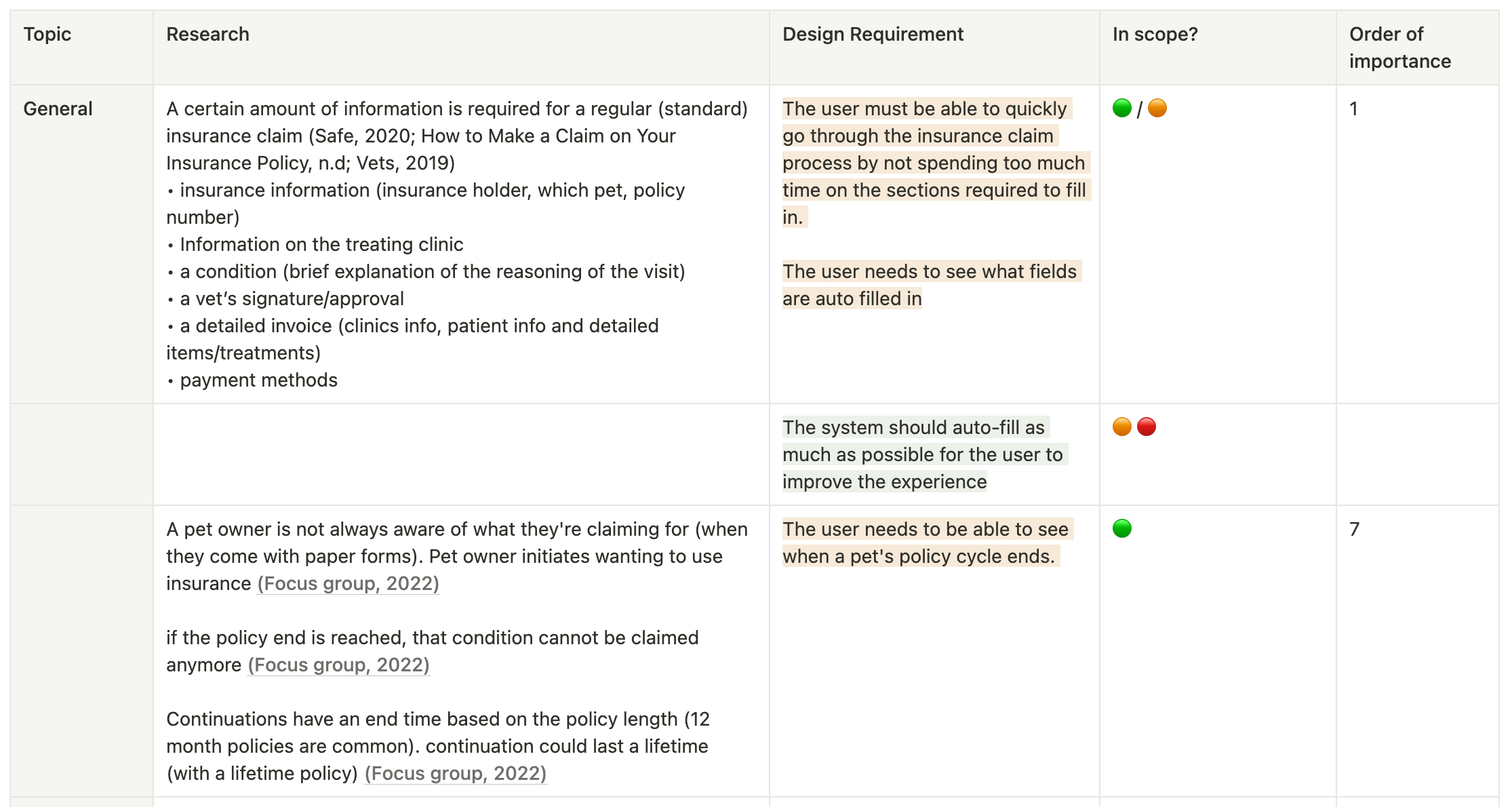

Filing insurance claims is always a tricky process, add cultural components, laws, and regulations on top of this and you have a complicated puzzle of information that needs to become coherent in a filing process. For this research project, I performed research to better understand the UK veterinary market and the needs of its users.